It’s no secret that I couldn’t possibly market my Forex products on my own, and I partner with a fantastic marketing and advertising firm that takes care of everything, including when I get a wild idea to do a members’ survey.

I can’t share all the results with you, but over the next week, I’ll be updating you with some of the results and pertinent information we learned about traders and trading from them.

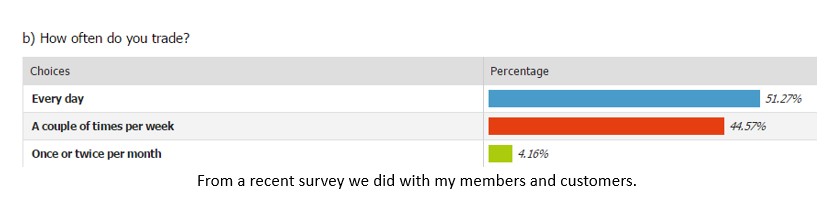

Have a look at this:

Of the traders we surveyed (and there were a lot!) over 50% trade every day, with another 44.57% trading a few times a week. That’s both fantastic and potentially really, really bad.

Let me explain.

I’ll give you a specific example. At the end of last week, the U.S. released its new NFP (non-farm payroll) figures. This is a monthly report of how many new non-agricultural jobs employers added in the United States.

Financial analysts make a lot of money “guessing,” based on a lot of factors, what that number might be.

- If you listened to them, and traded that “information,” you probably lost some money.

- If you traded, especially the USD, in the day or two leading up to that report, and the day of it, you probably lost some money.

Why? It was a great report that far outstripped expectations and showed 225,000 jobs added in a month. For the U.S. government and those 225,000 newly employed people it was a good day.

For traders, news events like this are kryptonite!

One of the biggest, most important lessons I harp on, every day, with my members is to know and even embrace “non-tradeable conditions.” In fact, I think of things like NFP report days as Trader’s Holidays.

Everyone knows when the NFP report is coming out. Just like everyone knows when the Fed meets, when the IMF issues its regular reports, and when the Euro Zone updates its monthly and yearly figures.

And whenever one of these “news days,” is on the horizon, the markets go flat while everyone holds their breath. So in the days leading up to one of these regularly scheduled reports, I take a Trader’s Holiday.

What other profession in the world lets you take a three or four-day weekend a couple of times a month? It’s really fantastic. Sometimes I put all the kids in the car and head to a bit of the forest for a camping trip, and sometimes, like this NFP report holiday, I just enjoy sleeping in, cooking pancakes for breakfast, and being the Dad taxi.

- I’m not losing any money because the market is flat and there’s little to nothing to be made.

- If I did trade, it would be for tiny movements and very little money, and it would cost me more to manage the trades than to just go dark for a couple of days.

- Monday, when the markets open up, fresh and happy (or sad, depending on the news), the trend is well-established and the canaries have already died in the coal mine by trading too soon, so the garbage is already out of the way.

Now, I get it, truly I do, that it’s hard to walk away from your charts for even one day, let alone three or four, and there is technology available, some of it I’ve even developed myself, that will let you keep your trading with you and manage it all from your smartphone…

But if you do not see a good trade, it’s probably best to just put the thing on silent and enjoy your life for a few days. The market will be there, waiting and flush with cash, whenever you come back to it.

You can learn more about my philosophy on non-tradeable conditions in my book, How to Make a Fortune Trading Forex.